Asset Tokenization

Rapidly convert real-estate, artwork, commodities, and more into fully compliant digital tokens.

Nullam dignissim, ante scelerisque the is euismod fermentum odio sem semper the is erat, a feugiat leo urna eget eros. Duis Aenean a imperdiet risus.

Seamlessly transform real-world assets into on-chain value that moves without borders, limits, or delays .

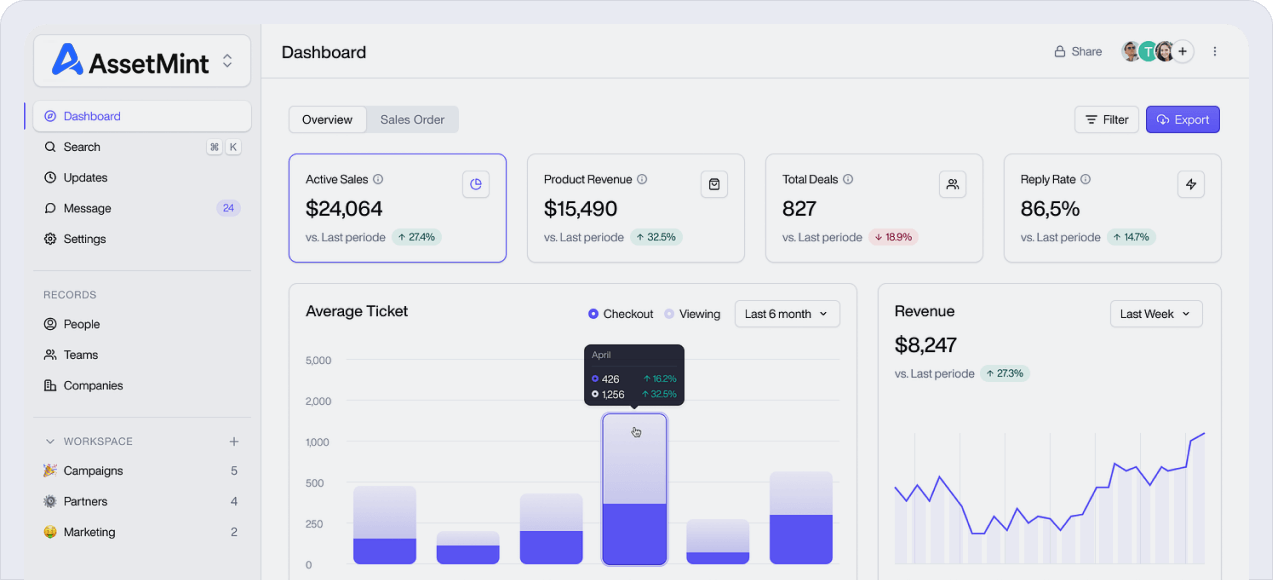

AssetMint: One-click tokenization of real-world assets with compliant trading, custody, and on-chain payouts.

Rapidly convert real-estate, artwork, commodities, and more into fully compliant digital tokens.

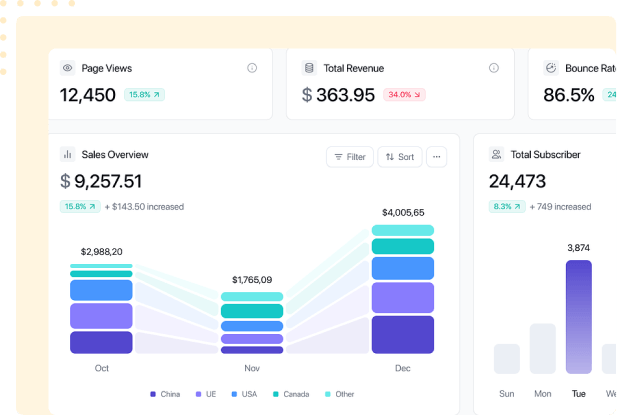

Built-in DEX/OTC modules deliver deep liquidity and instant order matching.

Multi-jurisdiction identity verification, anti-money-laundering, and securities-law toolkits.

Multisig custody, cold/hot wallet integrations, and seamless asset management.

Off-chain valuations, ratings, and live market feeds for transparent, reliable pricing.

Automated dividend, interest, and profit-sharing payouts via on-chain smart contracts.

Advanced blockchain infrastructure delivering secure, compliant, and efficient asset tokenization.

Built-in KYC/AML and securities checks block illicit funds before settlement, with every action immutably logged on-chain.

Assets can be split or recombined on demand, lowering entry barriers while letting large holders consolidate influence.

An AMM layer supplies 24/7 liquidity, while a pro-market-maker layer clears block trades; liquidity auto-shifts to keep slippage near zero.

Off-chain yields—rent, interest, dividends—are tokenized and streamed to holders automatically, turning cash flows into on-chain passive income.

Dropbox

Google Drive

Slack

Discord

Zoom

Hubspot

Github

Shopify

Mailchimp

Notion

Be among the first to access exclusive tokenization opportunities and early platform features.

Three specialists—spanning finance, regulation, and protocol engineering—combine decades of expertise to turn real-world assets into borderless, on-chain value.

Find answers to common questions about AssetMint's tokenization platform,

compliance features, and asset management capabilities.

Residential and commercial real estate, artwork and collectibles, commodities such as gold or oil, fixed-income instruments, receivables, and verified carbon or ESG projects are all eligible.

Every transaction passes built-in KYC/AML and multi-jurisdiction securities checks, while smart contracts undergo external audits. Assets are stored with institution-grade multisig custody and cold/hot segregation, and all actions are immutably logged on-chain.

Oracles periodically price the cash flows, mint yield tokens, and the protocol automatically streams those tokens to holders pro-rata—no manual claims required.

AssetMint supports leading self-custody wallets such as MetaMask, Ledger, and Fireblocks, plus institutional custody via syndicated or white-label accounts to meet both individual and enterprise needs.